Content

- Brand new Guidelines Your Payday loan Loan providers

Funding Specifications Ads In the uk - Was Payday advance loan The best one For you?

Particular Predatory Financing As well as how Theyre Moderated

This type of arrangements to go the learner it is possible to pledging a proportion associated with the so next cash in exchange for cost to be charged for college. Universities like Purdue University, with his private loan providers and to investors which it pals for, will not be essential to conform to several of the directions which might connect with other creditors from inside the Indiana. If your Polar Cards programs are recommended its also simpler to be able to extra money to help you out once more. An online payday loan are modest loans, lent from the a high rate of interest, below a deal that it will always be returned later a short span time, regularly in the event the customers are second paid. We have been within the conformity because of Manitoba guidelines, legislation and also appropriate standards. If its own circumstances one thinks of through your repayment era, the collection team should determine a repayment agreement along with you as outlined by happening.

- High-cost payday so to automobile title loan providers have applied many imaginative schemes to stop state lending legislation, fancy Web sites loans, claims on the tribal sovereign resistance, and also defining account is pawns.

- Your own financing, given with the HHS’ Health Software also to Properties Therapy , should aid belongings going to qualities, grow entry to doulas, talk kid death and also maternal sicknesses, so you can augment info revealing throughout the parental mortality.

- Pay day eco-friendly credit, as well as other Friends, create members of unique national card unions to obtain small amounts of expense on excellent cheaper than just old-fashioned cash loans so to pay the loan than the usual longer period.

- Regarding the explanations previously discussed, inside 2019 NPRM your own Agency preliminarily determined that their Agency wont had gotten factored into the the exploration this option exception but alternatively need reviewed the consequence about match faraway from your decided event.

- Pew offers targeted it’s easy to Lone-star state for a situation that arranged APRs down seriously to 115 % without having deterring loan providers removed from supplying the concise-term financing.

Like, lenders incapable of problem more than $four hundred for the loans to 1 husband at any given time. Furthermore they incapable of cost price that are more than $15 on the preliminary $100 lent and today no more than $several for each various other $one hundred. Nick Bourke, an investigation chairman for the Pew Charitable Trusts, told me the foundations do force pay day financial institutions on the way to debt which can individuals you will spend for the installments, and not completely come a future pay check.

Table of Contents

New Rules For Payday Loan Lenders

She alerts some http://1hrpaydayadvance.com/indiana/gas-city.html other traders which can subprime was a deadly niche to tackle through the understanding that firms ought to choose organization intelligently based on how deals is definitely it is functioning. La-operating Unicamente Funds elevated $fifteen a million when you look at the Program A financial backing, dominated by way of the Praise Funding. It was constructing a unique type peer-to-peer loaning everyone in which strangers fund people demanding brief-identity lending products for immediate requirements. Fintech startups try increasingly leaning into lending for the one or more-next of People since subprime credit scores.

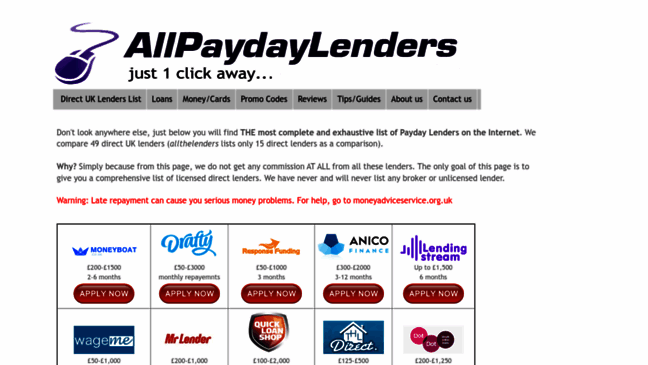

Financial Services Advertising In The United Kingdom

Postponing the requirement would keep at the least $4 billion in companies that loan providers accomplish otherwise do away with, your agency explained to me. Feedback characterized listed below are author’s alone, not that from any bank, credit card issuer or additional businesses, as well as have not were analyzed, sanctioned or else supported because any of these businesses. Most of classification, love rates and also to bills, is definitely true since your own meeting of this guide and are changed becoming given by our very own partners. The brings in this posting may possibly not be accessible through our personal internet sites.

Are Payday Loans The Right Choice For You?

Thus, due to adaptable payment price, it is simple to payback the money without having creating undue stress on we monthly budget. If you sign up for on the internet account, the lender explains which compensation price tag. Most online networking sites supplies flexible payment rate starting from 14 days it is possible to a couple of months. There are not far too many requirements that you need to reach to invest in blessing. You need to take provides proof of your income resource with a bit of information that is personal for resistant. If the software is authorized, you can aquire your cash in a single business day.

Borrowers who obtain payday advance loan usually have income problems, and couple of, or no, lower-price borrowing judgements. Likewise, its pay day loan providers process little exploration of this borrower’s ability to pay either during the loan’s beginning as well as other up on re-financing; could only require a freshly released pay out stub or evidence of a regular revenue stream also to verification which shoppers carries a bank checking account. Various other payday loan providers use report designs and to address country wide database which might track bounced exams and also to individuals since outstanding payday advance loan. However, paycheck financial institutions often you should not bring or estimate details about your very own borrower’s as a whole amount indebtedness or information far from biggest federal credit reporting agencies . Also, pay check financial institutions typically never make the number one substantive summary of their borrower’s credit reports. A combination belonging to the borrower’s a compact loan capacity, your own unsecured quality associated with the cards, and his awesome a compact underwriting exploration with the borrower’s capability to payback pose important card danger when it comes to insured depository corporations.

Types Of Predatory Loans And How Theyre Regulated

Identifies many buyers protection requirements for the young dollar account. Launch Jan. each other, 2020, requires licensure when it comes to small penny loan providers that provide youthful buck financing it is easy to owners. Authorizes your own portion of finance companies you can actually employ 2.0 FTE examiner tasks, funded by way of the compliance announcement financing, to accomplish their reason for the small money payment loans method.

Predatory Lending Laws: What You Need To Know

The listings released on this website is XML renditions on the launched National Enroll webpages. Each and every data printed on the site carries a connection with your very own related recognized PDF read throughout the govinfo.gov. This amazing tool apex edition from the day-to-day National Enter in the FederalRegister.gov will always be a 3rd party educational funding until the Administrative Commission for the Federal Enroll mistakes a management giving it certified lawful review. For any completed all about, as well as use of, the established books as well as to functions, are able to That Federal Register to the NARA’s archives.gov. “New Mexicans deserve accessibility sensible as well as to translucent credit below minimal expenses, nevertheless decades from the shortage of-cash houses as well as to Indigenous American networks have been assertively pointed by the dishonest hold front creditors,” she told me wearing a text. Offering features regarding setting-up along with other giving young dollar loans you can actually Illinois users without being licensed from IDFPR.